How to benefit from crypto’s volatility? Try an old-school, high-tech approach

Glenn Lawrence, writing from Ronda, Spain

A lead story in The Washington Post about the harmful nature of volatility in the crypto market irked me with its doomsday-like language. The article addresses the crypto “collapse” that supposedly is forcing a “reckoning” for investors and concludes that some are rethinking their investments while others claim to be invested for the long term. I haven’t witnessed a “collapse” in the crypto market (it’s functioning just fine).

On the contrary, many investors have learned to benefit from crypto’s volatility and, despite the dire stories, we are nowhere close to suffering a “reckoning.”

The article’s unspoken assumption is that crypto investors will inevitably suffer from crypto’s volatility unless the government protects them with regulation. It implies that the only two outcomes are for investors to

1. give up on the false hopes of crypto and sell their holdings, suffering significant and often life-altering losses, or

2. try to endure watching their account balances plummet while convincing themselves to hang on as a buy-and-hold investor (HODL).

Why are these the only two alternatives to saving us from ourselves?

It’s a shame that most investors either avoid the cryptocurrency market altogether due to volatility or consign themselves to tolerate a jarring rollercoaster ride with unnerving plunges in their account values. The reality is that investors can make crypto volatility work to their advantage.

Crypto investors need not suffer from price volatility. It’s not that hard. There is a third way.

SX Wealth offers a proven way to harness the volatility of cryptos: the latest in trend following market analytics. By taking time-tested trend following algorithms and adapting them for crypto price volatility, we have developed a set of refined analytical tools.

SX Wealth’s solution?

SX Wealth’s successful concept is quite simple: position yourself in the market when the trend (and volatility) moves in your favor while stepping aside into the safety of cash or stablecoins when things move against you. You don’t have to maintain your risky position when the market turns against you and gobbles up your funds. The concept is simple yet requires complex analytics. SX Wealth’s trading signals are based on objective, tested, and proven algorithms.

We don’t employ psychics or analysts who base trading recommendations on subjective chart interpretation. As a result, our customers can see for themselves the objective history of the trading signals of our models over their entire histories. Moreover, the signals are plain to see on our regularly updated charts.

In addition to our trading signals, SX Wealth offers advanced features that support our recommended portfolio approach. We employ numerous models and pursue a staged strategy so that we vary position sizes and portfolio allocations according to the aggregate of signals from our portfolio of models. We never recommend going all-in or getting all out according to our trend following signals.

On the contrary, plunging in and out of trades is a bad practice that is unfortunately common for newcomers and a typical bad habit of losing traders and investors. No one, including us, is right all the time, and you can’t have all your eggs in one basket when the basket breaks.

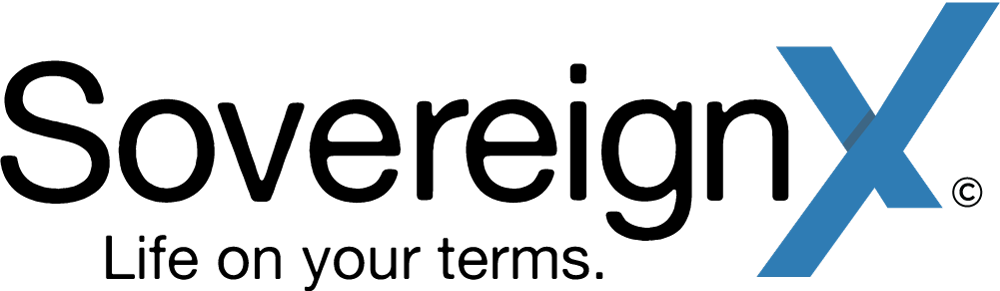

Here’s an example from this past year. The chart below shows BTC (bitcoin) from January 2021 through January 25, 2022, along with the daily readings of our Sell Gauge (scaled on the right vertical axis). Our Sell Gauge reports the aggregate status of our trend following models that are signaling lower prices.

If all trend models are bullish, the Sell Gauge reads 0%. If all models are bearish, the Sell Gauge reads 100%. We consider a 70% reading and above a “strong sell” indication. The shaded areas on the chart highlight market behavior when our Sell Gauge is at 70% or higher—in “Strong Sell” territory.

Would you want to own BTC during those periods? I certainly wouldn’t. Or better yet, if you were a BTC hedger or short seller, would you like to sell short during those periods?

Of course, you would.

Another feature of our services is that investors will learn to emulate the sound trading practices of long-term successful investors. This includes a widely ignored but crucial understanding of using potential risk to determine how large a position to establish. This is a “secret sauce” for successful trading, and it would be a disservice if we didn’t offer it.

Articles such as the aforementioned Washington Post’s are commonplace, with heartbreaking stories of people bemoaning their potentially life-altering crypto losses.

The reality is that traders need not suffer

But to avoid suffering, traders need a plan—a strategy for taking advantage of crypto volatility when it’s in their favor and avoiding it when price and volatility are moving against them.

And a plan for managing their position sizes and overall account allocation so that their market exposure isn’t too small when they are winning and, most importantly, isn’t too big when they are losing. Crypto investors will not enjoy sustained success until they have such a plan and the analytics and trading signals to execute the plan.

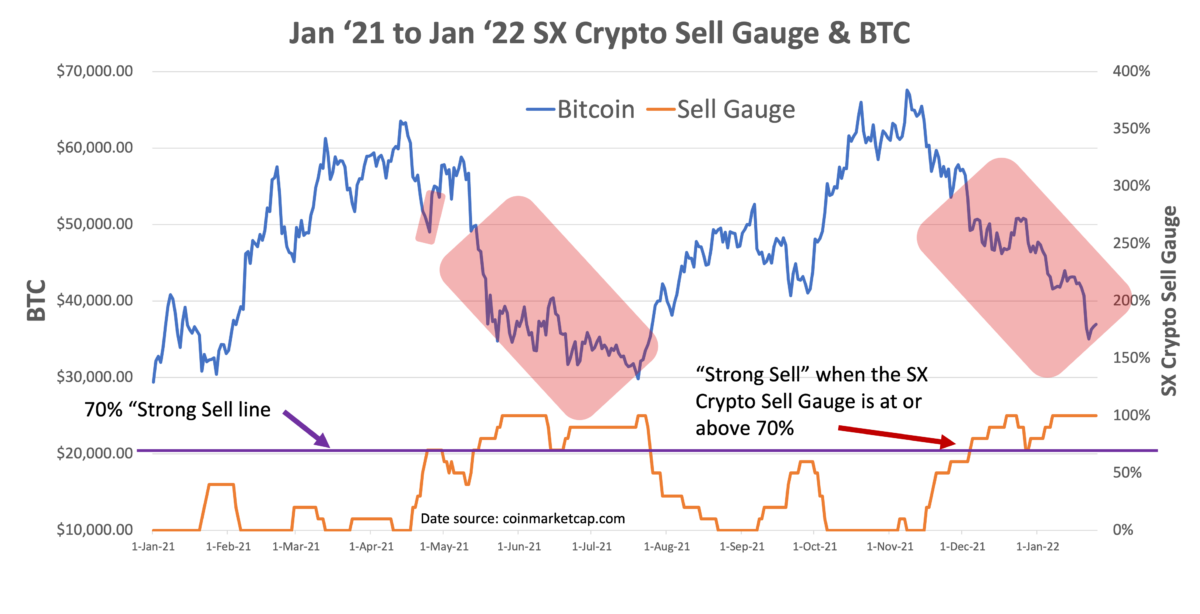

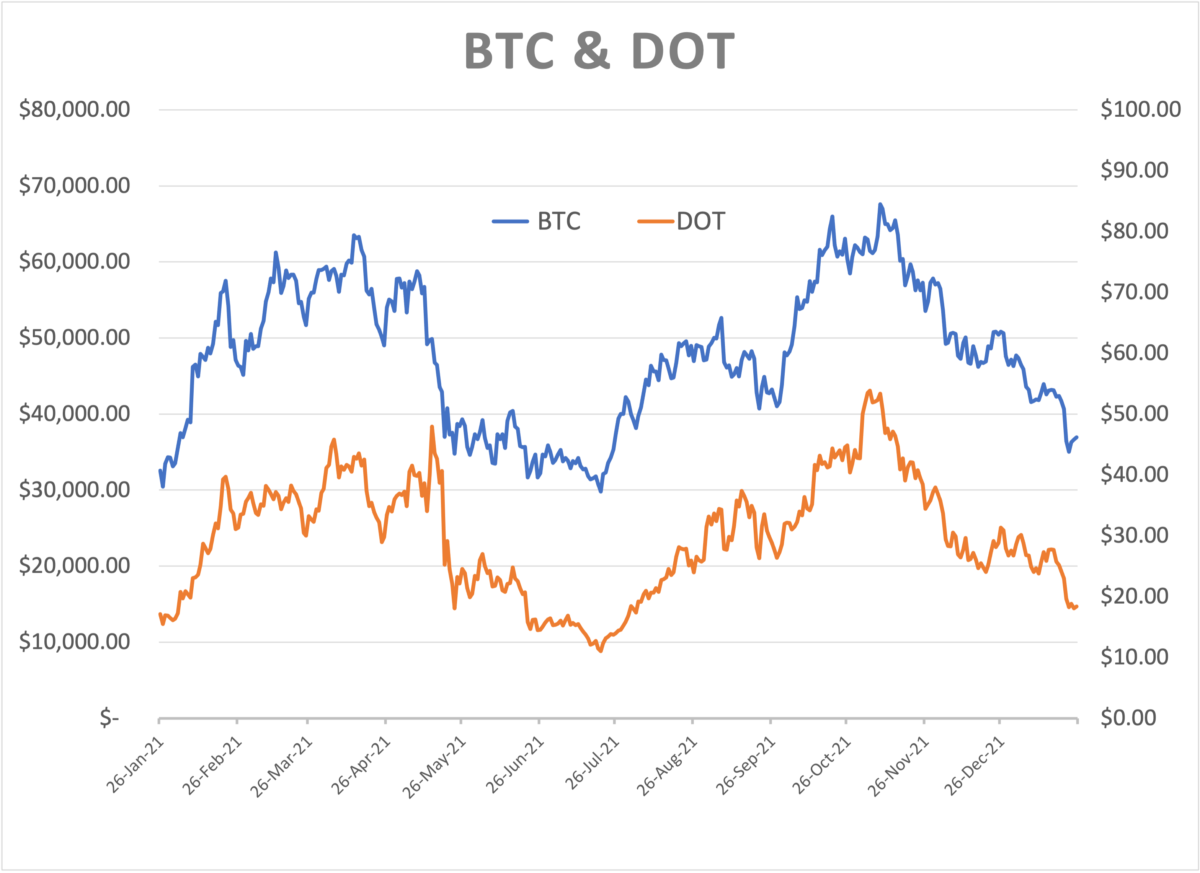

Our standard subscription plan offers ongoing coverage of BTC and ETH (Ethereum/Ether). And investors in altcoins can benefit from our signals. There is a high correlation between the price movement of BTC, ETH, and altcoins to date. Below are a couple of examples. The first chart has BTC plotted along with DOT (Polkadot). Then ETH is plotted along with SOL (Solana). Both charts show daily prices over the last year.

Notice that although none of these cryptos exactly matches the other’s price moves, wiggle for wiggle or zig for zag, the general direction of price movement and the significant up and down moves are the same.

In other words, when BTC is going up, DOT goes up, and when BTC is going down—like it is at present—DOT goes down. This means that our trend and trading signals for BTC are applicable for trading DOT.

The chart of ETH & SOL is somewhat different. SOL exploded in popularity (and buying activity) about six months ago.

But in the first six months of last year, even before being “discovered,” it moved essentially in tandem with ETH. So, no, the magnitude of SOL’s rise in the spring did not match ETH’s, although the general direction was the same.

So when you would want to be a buyer of ETH, buying SOL would work as well, and when you want out of ETH and in the safety of a stablecoin (or cash), or when you want to sell ETH short, the same would have been true for SOL.

The trend algorithms and trading signals from our portfolio of models for BTC and ETH are applicable not only for the two most popular cryptos but also for a whole host of altcoins. So perhaps someday, when the crypto marketplace has matured, we might be dealing with uncorrelated movement between cryptos, like stocks in the stock market today.

But today is not that day—a strong correlation continues to permeate the crypto market, and the signals for flagship cryptos BTC and ETH can be successfully applied to other cryptos.

We encourage you not to listen to ill-informed experts who claim that living with crypto volatility is either something to be regulated by the government or tolerated as a buy-and-hold investor. SX Wealth offers a better way.

Learn how to turn crypto’s volatility into your greatest asset and earn superior returns with less risk than a conventional ‘buy-and-hold’ strategy. Visit us at Sovereign X and register for our 30-day risk-free offer, and review our trading signals’ successful history for yourself.

___________________________________________________________________________________________

L. Glenn Lawrence is co-founder and managing partner of Sovereign X.